Insurance Policy

General Terms and Conditions

-

Definitions

-

Company: Herein zantexplorer.com is also referred to as a company.

-

Insured person or policyholder: The natural person (s) on whose behalf the lease contract is concluded.

-

Insured persons: They are the main driver of the rental vehicle as well as all the additional drivers explicitly mentioned in the rental contract.

-

Beneficiaries: The persons who will receive the amount of the insurance coverage limit provided for in the insurance policy, in the event of the insured person's death.

-

Rental Agreement: The rental agreement of the vehicle concluded between the customer and the company. The rental contract of the vehicle is also the insurance contract between the company and the policyholder.

-

Insurance policy or insurance contract: It is the insurance contract between the company and the insurance company in order to insure the vehicle. The insurance coverage provided is explicitly mentioned in the insurance policy.

-

Vehicle: The expressly described vehicle mentioned in the rental agreement.

-

Accident: The incident that happened due to a sudden cause.

-

Insurance value: The replacement value of the vehicle

-

Insurance term : The period mentioned in the rental agreement.

-

Exemption: The amount with which the policyholder participates in the costs of repairing the damage.

-

Young Driver: A person under the age of 23 or who has first obtained a driving licence within the last twelve months and who is going to drive the insured vehicle.

-

Coverage limits: The geographical limits set by the lease agreement.

-

Maximum insurance coverage: The maximum amount of money to be paid for each covered case. This amount cannot not exceed, in any case, the prescribed insurance limit stated in the insurance policy, for the covered driver.

-

Insurer : The insurance company that insures the vehicle and provides the necessary coverage.

-

Object of the insurance: The accident that the driver is subject to, for which the insurance of the vehicle was concluded.

-

Loss of life due to an accident: It describes the event in which the insured person loses his life as a result of an accident.

-

Validity of the insurance .

This contract is governed by the applicable insurance legislation and the general and special terms agreed. The special terms prevail over the general terms.

-

Local validity limits.

Liability insurance is valid only within the geographical limits of the Greek territory.

-

Maximum Liability limit.

The maximum limits of liability of the company for each accident are described in the insurance policy of the vehicle which the company has concluded with a cooperating insurance agency. A copy of this document may be sent to the policyholder upon request. Any translation costs shall be borne by the requestor.

-

Duration of insurance

The insurance is valid for the period stated in the rental agreement of the vehicle.

-

General obligations of the policyholder and/or the insured person in case of damage.

In the event of damage, the insured has the obligation to notify the company immediately and immediately make the insured vehicle available to it.

-

Cancellation of the insurance policy.

The insurance policy accompanied by the rental agreement of the vehicle cannot be cancelled.

-

Amendment of the insurance policy

The insurance policy in force may be amended at the request of the insured.

-

Settlement of damage.

Only the company has the right to fully investigate the causes of the damage and the circumstances under which it occurred.

-

Court jurisdiction

The Greek courts are competent for the resolution of any disputes that may arise between the company and the insured person as a result of the insurance policy and the Greek legislation is applicable.

-

Limitation period

Any claim of the insured arising from the insurance policy is time barred after (4) four years from the end of the year in which the claim arose.

-

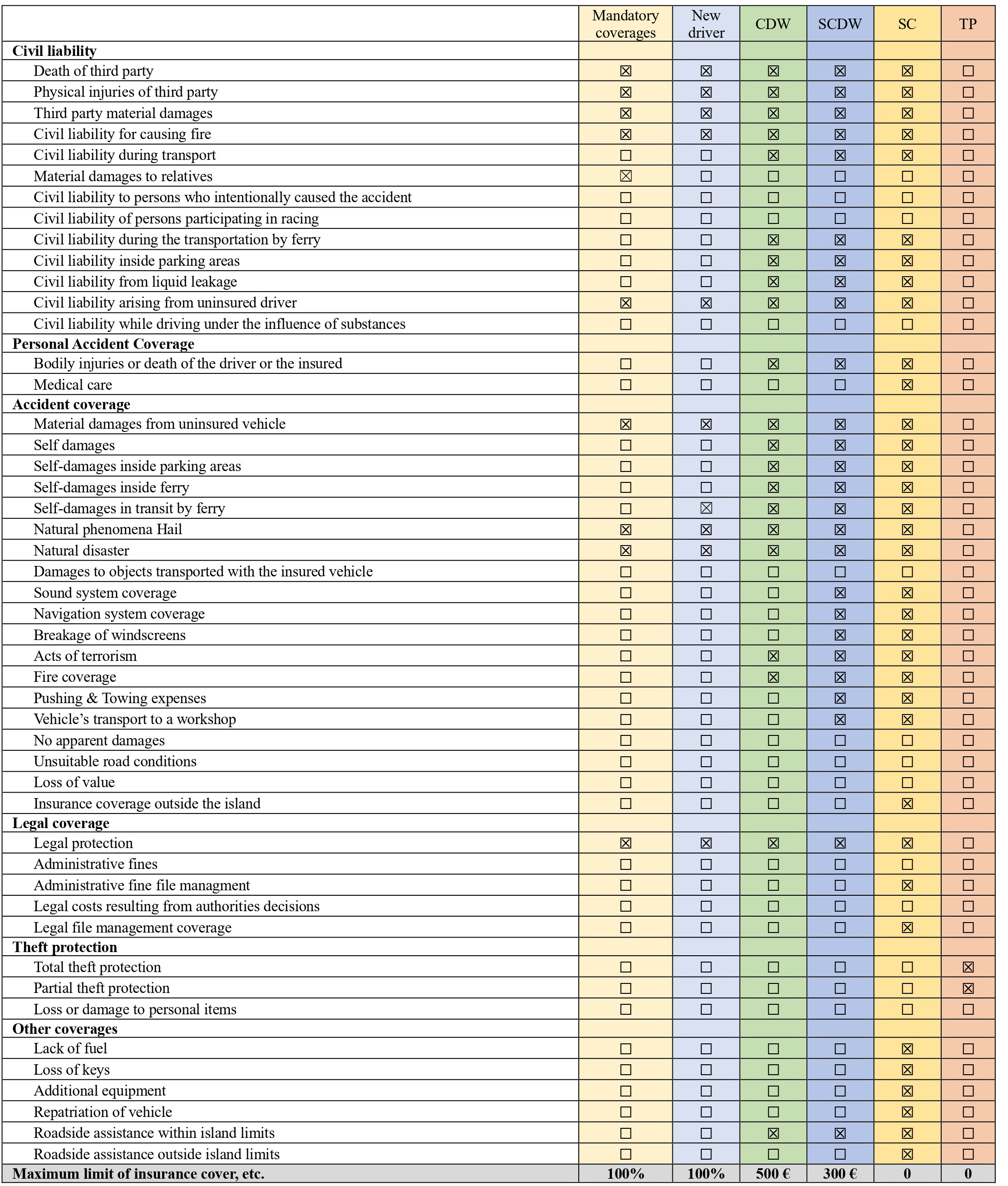

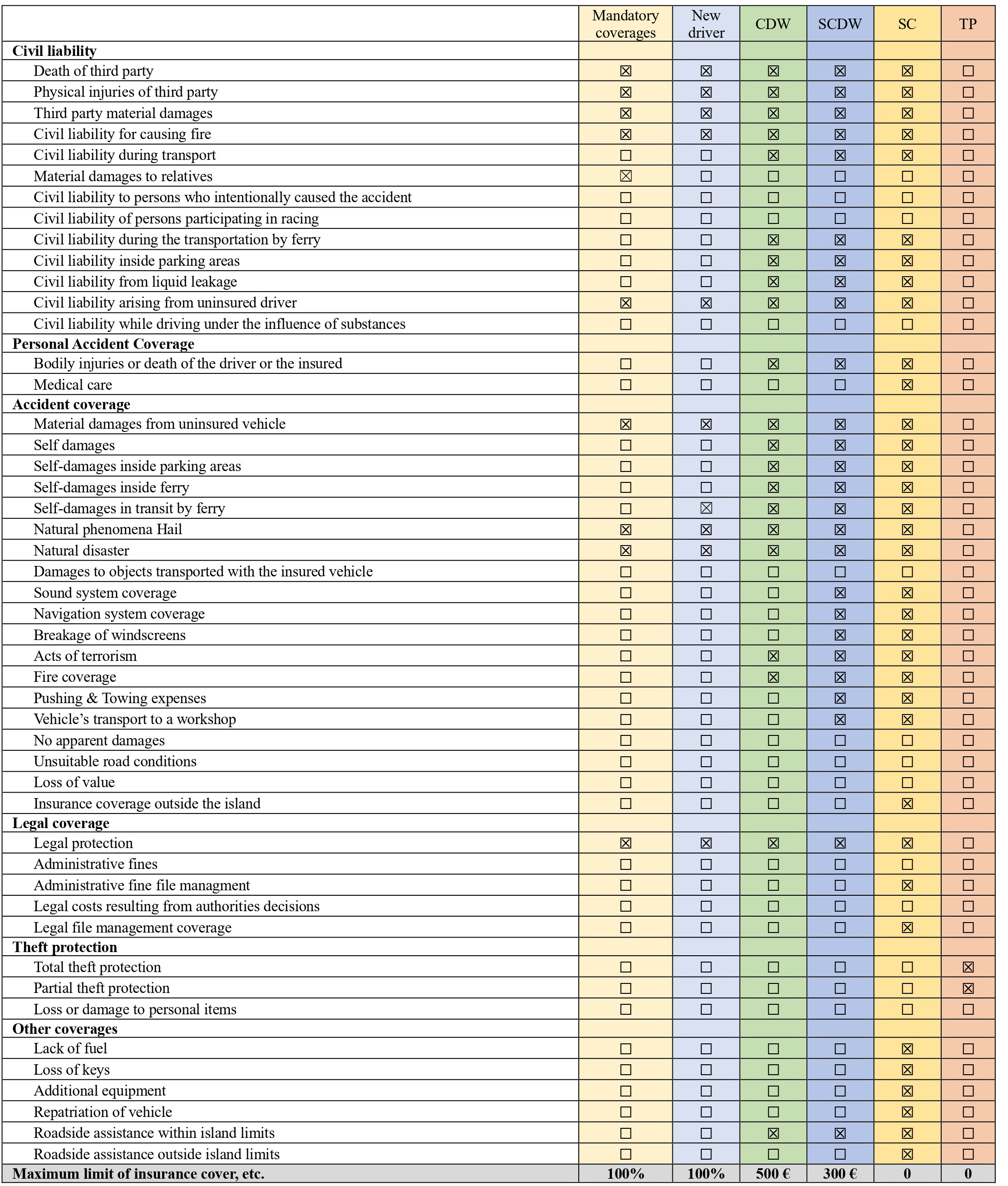

Insured risks covered by the insurance policy.

Of the risks mentioned herein, only those referring to the type of insurance coverage agreed upon during the drafting of the rental agreement apply.

Special Terms

-

Third Party Liability Coverage:

-

Third party civil liability: It includes the satisfaction of legal claims of third parties against the insured, for death, physical injuries and material damages caused by the circulation of the rented vehicle. (The exceptions of paragraph 1 apply)

-

Third party liability for vehicle fire propagation: The company insures against material damage suffered by a third party due to the fault of the policyholder as a result of fire propagation or explosion of the insured vehicle. (The exceptions of paragraph 1 and 2 apply)

-

Civil liability during the transportation of the vehicle & inside guarded areas: The company insures for material damages that a third party may suffer due to the fault of the policyholder during manoeuvres within private parking areas, ships and ferries (The exceptions of paragraph 1 and 2 apply)

-

Damages from falling objects carried by the insured vehicle or from protruding objects: Damages to third parties from falling objects carried by the vehicle or from objects protruding from the vehicle are covered. (The exceptions of paragraph 1, 2 and 3 apply)

-

Natural phenomena: Damage caused by storms, flood, hail, hurricane and earthquake are covered.

-

Material damages by uninsured vehicle

The material damage caused by collision of the insured vehicle with another known non-insured vehicle,under responsibility of the latter, is covered.

-

Fire, natural phenomena, hail, natural disasters, stoppages - strikes - riots - demonstrations - political riots, terrorist acts

This insurance covers the damages to insured vehicle from fire, lightning, natural phenomena, hail, natural disasters, explosions and terrorist acts as well as other material damages, resulting from stoppages, strikes, riots, demonstrations, civil unrest.

-

Total Theft

The total loss of the insured vehicle, which has been stolen, is covered.

-

Partial theft

The partial theft insurance covers:

-

The value of the items or parts of the vehicle that have been stolen and are solidly attached to it.

-

The value of the vehicle's interior fittings.

-

Damage caused to the body of the car at the time of removal and/or attempt to remove vehicle parts.

-

In the event that the damage is violation of a fabric folding roof of an open-type vehicle (cabrio), an amount of €400.00 shall be borne by the insured and the company shall be liable only for the amount exceeding this exemption.

-

Glass breakage

Damage to the car glass resulting from breakage by any cause is covered. Up to a value of € 1000.

-

Οwn damages

Own damage insurance covers damage to the insured car caused solely by collision, impact, diversion, overturning, fall and directly by malicious action of third parties, on a public road, in a parking lot, in a port and when travelling by ferry.

-

Special condition for new drivers

The policyholder has the obligation, at the conclusion of the contract, but also at each renewal of it, to declare to the company if a new driver is going to drive the insured vehicle, so that the company can calculate and collect an additional premium (risk premium).

-

Personal accident of the driver

-

Permanent total disability: Permanent total disability, which occurred exclusively as a consequence of an accident, is covered within one (1) year at the latest from the day the accident occurred. (The exceptions of paragraphs 4-14 apply)

-

Permanent partial disability: is considered the permanent partial reduction of the insured's capacity for any work, which, however, does not constitute permanent total disability as defined in the above paragraph. In case of permanent partial incapacity, the insurance is a percentage of the coverage limit prescribed for permanent total incapacity (The exceptions of paragraphs 4-14 apply)

-

Special chapter on legal protection

Insured risks

With this coverage, the company undertakes:

-

The payment of the lawyer's fee.

-

The payment of the court fees.

-

The payment of the litigation costs of the opposing party.

-

The coverage limit outside Greece does not exceed €1,500

The company does not pay:

-

Amicable settlement costs.

-

Those costs which are or would be required to be paid by a third party if there would be no Legal Protection insurance

-

The expenses generated by failure to act of the policyholder.

Local limits of insurance protection

Insurance protection is provided in those insurance cases that occurred:

• In Greece

• In member states of the European Union

Choice of lawyer and assignment of mandate

The mandate to the lawyer is granted only by the company, in the name and by order of the policyholder and/or the insured.

Other obligations and rights of the company

The company, under no circumstances, has the obligation to pay any amount (e.g. interest, expenses, etc.) greater in total than the maximum coverage limit provided for in the policy.

Management of fine dossier

The company may undertake the processing of administrative fines incurred by the insured at his request.

Legal dossier management

The company may undertake to keep the legal dossier of the accident at the request of the insured.

-

Accident care

The company provides accident care to its insured persons, in the event of an accident or damage to the vehicle, within a reasonable time, depending on the distance and the prevailing traffic and weather conditions. (The exceptions of paragraphs 15-17 apply)

-

Medical care

The company provides medical care to the insured. A Medical Doctor collaborating with the company undertakes, at the request of the insured, the provision of medical information to the insured, keeping them updated and the establishment of the necessary medical file. Any costs of official translation of documents shall be borne by the insured.

-

Road Assistance

The road assistance coverage is provided only to the company's vehicles and within the geographical limits of the prefecture of Zakynthos depending on the distance, the traffic and weather conditions. In case of damage to the insured vehicle, an attempt is made to repair the damage on the spot, if possible. In case of a damaged tyre and if the rental vehicle does not have a spare tyre, an auxiliary wheel from the company's equipment is installed on it, in order for the vehicle to keep moving.

If the damage can be fixed by the means available to the mobile workshop, it is repaired it and the vehicle is put back to circulation.

Road assistance is provided only if the road assistance vehicle is able to access the location of the insured vehicle.

The obligation of the company continues to exist in cases of changing the vehicle for the remaining duration of the contract. (The exceptions of paragraphs 15-18 apply)

-

Other coverage

Lack of fuel. The company undertakes the filling of the fuel tank in case of immobilization due to its lack.

Loss of keys The insured is covered in case of loss of keys.

Additional Equipment. The extra equipment that is permanently fitted on the vehicle is covered in case of damage or wear.

Vehicle repatriation. The company undertakes the transportation of the immobilized vehicle to its seat.

Road assistance outside the island. Article 26 coverage is extended throughout the Greek territory.

-

Obligations of the Insurer and the Insured

The policyholder and the insured are obliged to declare at the beginning of this insurance to the company, in all sincerity, all the information necessary for the conclusion of the vehicle rental contract. The misrepresentation or concealment of facts that are decisive for not assuming the insurance risk releases the insurer from his obligations.

The insurer has the right to terminate the insurance if an untrue statement, withholding of information and misuse of benefits is found, without reimbursement of the premiums paid. If during the insurance period there is, even temporarily, a change in the risks covered by the insurance policy, so that they cease to respond to the statements of the insurance proposal, the insured is obliged to notify the company in writing within 48 hours of this change, otherwise he loses the rights granted to him by this insurance policy. In the event of being informed, the company has the right either to immediately terminate the insurance or to extend it with the issuance of an additional act by collecting the additional premiums that will be agreed.

Exceptions.

Civil liability

-

Not considered Third Parties:

-

The driver of the vehicle that caused the damage.

-

Any person whose liability is covered by the rental agreement.

-

The damages excluded from the insurance are damages caused:

-

By a driver who does not hold a legal driving licence.

-

By a driver under the influence of alcohol, toxic, narcotic drugs or other substances;

-

When the vehicle is used for a different use from that specified in the rental agreement.

-

By intent or gross negligence of the policyholder

-

From the participation of the insured vehicle in races, speed or skills competitions.

-

When the driver is younger than 23 years old or holds a driving license since less than one year.

-

When the vehicle is towing or being towed

-

When the vehicle is in guarded parking spaces.

-

Not covered and excluded from the insurance are damages caused:

-

When the transported or protruding objects of the vehicle are not safely secured on a special base of an approved type

-

By items deliberately discarded by the driver or the passengers of the vehicle.

-

By items transported by the vehicle.

Personal accident of the driver

-

In the event of suicide or attempted suicide of the insured.

-

In case the driver of the car suffers from paralysis, epilepsy, neurasthenia, psychiatric conditions or illnesses, dementia, or is intoxicated or if he is an alcoholic, a drug addict or disabled.

-

In the event of earthquake, flood, hurricane, storm, volcanic eruption and other natural phenomena

-

In the event of war, political unrest, acts of terrorism, disturbances of public order and similar actions or situations.

-

In case the insured vehicle participates in demonstrations or festive parades or in official or unofficial races or competitions of speed or skills or in relevant test routes (trainings).

-

In case the car is towing or being towed as well as in similar cases, unless there is written consent of the company to provide coverage.

-

In case the driver does not have the driving license provided for or its temporary or permanent suspension has been ordered.

-

By any kind of diseases, illnesses or conditions, even if they are classified by the court as accidents.

-

By accidents caused totally or partially, directly or indirectly by physical injury suffered by the insured before the accident as well as its consequences or complications.

-

In case there are more passengers in the car than provided for by the registration certificate or the car carries a load exceeding the limit provided for by the registration certificate or by the relevant decisions of the competent authorities.

-

In case the car is not lawfully circulating or used for the use provided for it or has not undergone the roadworthiness tests provided for by the applicable provisions

Care – Road Assistance

-

The company does not pay or compensate: for expenses paid to third parties by the policyholder for any reason or cause, without its prior approval.

-

The cost of ferry transport is borne by the renter of the vehicle.

-

For vehicles immobilized due to the loss of keys.

-

If the insured vehicle is located in inaccessible places such as rivers, lakes, sea, cliffs, ravines, etc.

-

In case of immobilization of the vehicle due to lack of fuel.